CEE banking sector still much more profitable than Western Europe

Tbilisi, 14 May 2015

- Profitability in the region approaching more sustainable levels but remains high compared to Western Europe

- Economic recovery in the region should lead to moderate credit growth and slight improvement in non-performing loans in some countries

- Alternative products and services a promising opportunity beyond lending

The banking sector in Central and Eastern Europe (CEE1) changed significantly as a result of the global financial crisis in 2008 / 2009. While its profitability still lies above Western European figures, it is moving closer to more sustainable levels than in the pre-crisis period. This is one of the key findings of the “Business Opportunities for Banks in CEE” study compiled by CEE Strategic Analysis at UniCredit. Loans remain the most important bank product overall, but alternative services should encounter higher customer demand.

Profitability levels off at more sustainable level

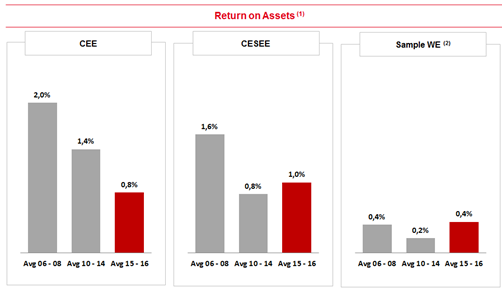

CEE banks are still more profitable than those in Western Europe, but their earnings power is noticeably levelling off at a more sustainable level. While their return on assets in the boom years before the crisis (2006 to 2008) stood at an average of 2 percent, between 2010 and 2014 it amounted to 1.4 percent. In 2015 and 2016, influenced by the situation in Russia, it should reach 0.8 percent. According to analysis by UniCredit experts, the return on assets for credit institutions in Central and South-Eastern Europe (CESEE2) in the above mentioned three periods is 1.6, 0.8 and 1.0 percent, respectively. Banks in Germany, Italy and Austria, by contrast, produce figures of 0.4, 0.2 and 0.4 percent.

“In Central and Eastern Europe roughly two thirds of all income in the sector is generated by net interest income, i.e. in traditional banking business. Against the background of pressure on margins it will be vital to push alternative sources of income such as fees and commissions and boost the earnings power of banks”, said Carlo Vivaldi, Head of CEE Division at UniCredit.

Lending will remain the most important bank product in the future as well. “We are expecting moderate lending growth in line with the economic recovery in the region”, revealed Mauro Giorgio Marrano, Deputy Head of CEE Strategic Analysis. “In CESEE we anticipate growth of 3.9 percent this year and 4.6 percent next year. In CEE the rates will be 5.1 percent and 7.8 percent.” The pace of credit growth will differ significantly from country to country. The share of non-performing loans will remain relatively high this year. However, some improvement is envisaged in some countries.

Products that go beyond lending will play a greater role

“Alternative services away from traditional banking loans will undoubtedly gain in significance”, said Carlo Vivaldi. “According to our analyses, corporate customers will in the future fuel greater demand for non-traditional financing. With private customers I see potential particularly with asset management services.”

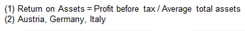

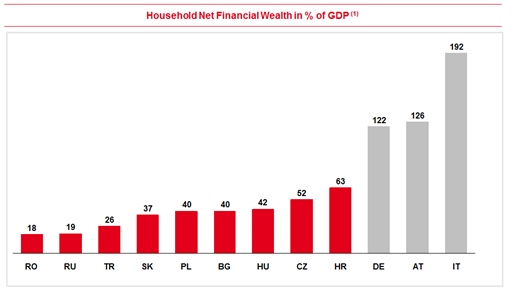

In fact, not only bank loans but also debt securities account for a much lower proportion of companies debt financing for CESEE companies, compared to Western European industrialized countries; the net financial wealth of private households in CEE is still below those of households in Germany, Italy and Austria, and they are invested in comparatively basic products. Wealth growth will create scope for greater demand for wealth management services going forward.

Use of the internet for banking transactions in CEE also still lags behind Western European levels. “Banking customers in Central and Eastern Europe are extremely tech-savvy. This is shown by the strong growth in online banking in recent years”, analysed Mauro Giorgio Marrano. “Modern customer services on internet are a crucial factor of success for banks in CEE.” Credit card payments in the region also display strong gains.

Expand market leadership in Central and Eastern Europe with new solutions

In spite of some challenges, UniCredit considers itself a long-term, strategic investor in Central and Eastern Europe and it is keen to expand its business with both corporate and private customers in the region. The banking group operates an extensive network of almost 3,500 branches in 14 countries, which generates roughly one quarter of its total revenue. UniCredit in CEE serves more than 20,000 international corporate customers through its International Centers. In this context it supports customers with their business by drawing on expertise in local law and market practices, helping them to identify and seize new opportunities.

“The deep roots of our local subsidiary banks are what gives UniCredit its strengths in Central and Eastern Europe. In the past four years we have expanded our market shares in both financing and customer deposits, in contrast to some of our competitors”, explained Carlo Vivaldi, Head of CEE Division at UniCredit. “We want to continue this positive trend. To this end, not only will we offer familiar services to customers at the usual high quality, but also trendsetting solutions for new requirements.”

UniCredit

UniCredit is one of the leading European commercial banks with strong roots in 17 European countries. Our world-wide network in roughly 50 markets comprises around 8,600 outlets and more than 145,000 employees (as of 31 December 2014).

The Group operates the largest international banking network in Central and Eastern Europe with almost 3,500 business outlets (including Poland and Turkey).

UniCredit is currently represented in the following countries: Austria, Azerbaijan, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Germany, Italy, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey, Ukraine and Hungary. UniCredit operates in the Baltic states with a leasing company (as of 31 December 2014).

Enquiries: International Media Relations

Tiemon Kiesenhofer, Tel.: +43 (0) 50505 56036

E-mail: tiemon.kiesenhofer@unicreditgroup.at

1 CEE comprises Bosnia-Herzegovina, Bulgaria, Croatia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Czech Republic, Turkey, Ukraine and Hungary.

2 CESEE means CEE without Russia, Turkey and Ukraine